Looking for a credit card that’s simple, mobile-friendly, and designed for modern needs? Discover how the Zopa Credit Card can simplify your financial life with ease.

Key Takeaways

- No Foreign Fees: Shop or travel abroad without incurring extra charges.

- Mobile-First Management: Manage everything via the Zopa app, from payments to card security.

- Straightforward Features: No confusing reward systems; enjoy a user-friendly credit card experience.

- Eligibility: Requires good credit history and a minimum income of £10,000.

- Transparent Costs: No annual fees but a high representative APR of 34.9%.

Are you looking for a mobile-friendly credit that not only helps you improve your credit score but also provides complete control? Then Zopa credit card review is the best way to find out why it is a win-win option for you.

Now, let’s move further and compare this with other credit cards available in the UK.

I think you must have heard about Zopa Bank. It is one of the newest banks in the UK at the time of digital banking.

Zopa Limited began its foundation in the year 2000s as one of the pioneers in the UK market. Zopa Bank secured its full UK banking license in 2020, marking a significant milestone in its evolution.

With time passes Zopa didn’t just stop at lending. It expanded its services to offer a wide range of online traditional banking products like savings accounts, a personal loan, or the Zopa Credit Card.

As a customer, Zopa allows you to access a wide range of services such as mobile app and a user-friendly website. They take the details from users and use them to make the services better, ensuring that borrowers and savers benefit from competitive rates.

In a very short Zopa Bank has won multiple banking rewards, like British Bank Awards’ Best Personal Loan Provider, Best Credit Card Provider at the British Bank Awards etc.

Now we will understand about the Zopa Credit Card.

What Is The Zopa Credit Card?

It is a digital first product credit card, meaning you can manage everything through the Zopa mobile app. Its features help you stay on top of your finances while ensuring top-tier security and protection.

It is a simple credit card with no complicated earning points or reward programs to change and confuse your spending decision.

What you see is what you get. A straightforward credit card that delivers on its promises means you get what it says with its new award-winning technology designed for modern credit card users.

Zopa Crad Eligible

To be eligible for the Zopa credit card you must meet the below criteria:-

- You must be a UK resident of more than 18 years old.

- Candidates must be registered on the electoral roll at your permanent address for at least one year.

- Your annual income must be at least £10,000.

- A good credit history is required.

- It is not a credit-building card,means this will not help to improve your credit score.

- Demonstrate responsible financial management with a solid payment history on loans or regular payments.

- Must have at least two active lines of credit, such as a mobile phone contract, credit card, or overdraft facility.

So, if you satisfy the above criteria, you can apply for Zopa Credit Card. Check the Application process mentioned in the article below.

Pros and Cons of the Zopa Credit Card

The Zopa Credit Card has pros and cons, making it suitable for some users and less ideal for others. Here are some Pros and cons of Zopa Credit Card:-

| Pros | Cons |

|---|---|

| No foreign transaction fees for shopping or traveling abroad | High representative APR of 34.9% |

| User-friendly app with instant spending notifications and in-app PIN viewing | £3 fee for cash withdrawals at home and abroad |

| Ability to freeze card in case of fraud or theft | High-interest charges if balance is not cleared monthly |

| No annual fee | |

| 56 days of interest-free period on purchases | |

| “Cash Cushion” feature for emergency spending | |

| Convenient emergency fund without needing a separate savings pot |

Is Zopa Credit Card best for You?

If you are looking for a credit card that provides you complete control over your credit card and can be utilized through your mobile, then Zopa credit card is one of the perfect choices for you.

Using the Zopa app, you can keep a close track of many parameters like credit score, credit limit and credit history. These things set this cards apart from rest of the credit card available in the market.

If you are like me, then you must prefer to manage your credit card digitally using your smartphone wherever you are.

Also, it is a good alternative to use the credit card while you are on a foreign trip as compared to the traditional credit card available in the UK market.

How does the Zopa card compare to other credit builder cards?

Here are the three points compared to other credit cards:-

Rewards Consideration

If rewards are your priority, Zopa may not be the best option for you as it doesn’t offer any reward-earning points. This is also not a credit card builder. But there are many credit card that offers you multiple rewards and points like Adsa and Tesco foundation credit cards. If you frequently shop at Tesco or Asda, these cards might be the best choice to explore.

Interest Rate Management

If your main concern is lowering your APR, then the Barclaycard Forward card could be a better choice. It features a “price promise” that could reduce your interest rate, provided you consistently make your full payment on time.

Credit Limit Increase

Vanquis might be the card to consider if you seek a higher credit limit. They conduct monthly reviews to assess your eligibility for a credit limit increase. This automatic review won’t affect your credit score and doesn’t require you to apply it again.

Features of Zopa Credit Card

Here are some of the features of Zopa Credit Card:-

- Personalised Credit Limit -Based on your credit score and the details provided, the starting limit is between £200 and £1,200.

- Free Mobile App -Award-winning app with real-time account monitoring, payment reminders, and money management insights.

- No Annual Fee- Enjoy credit card benefits without an annual fee (as long as the balance is paid off each month).

- APR Details – Interest rates are tailored to your circumstances, ranging from 27.3% to 34.90% APR.

- Other Fees

- £3 cash withdrawal fee (plus interest from the day of withdrawal).

- £12 late payment fee.

- There are no foreign transaction fees.

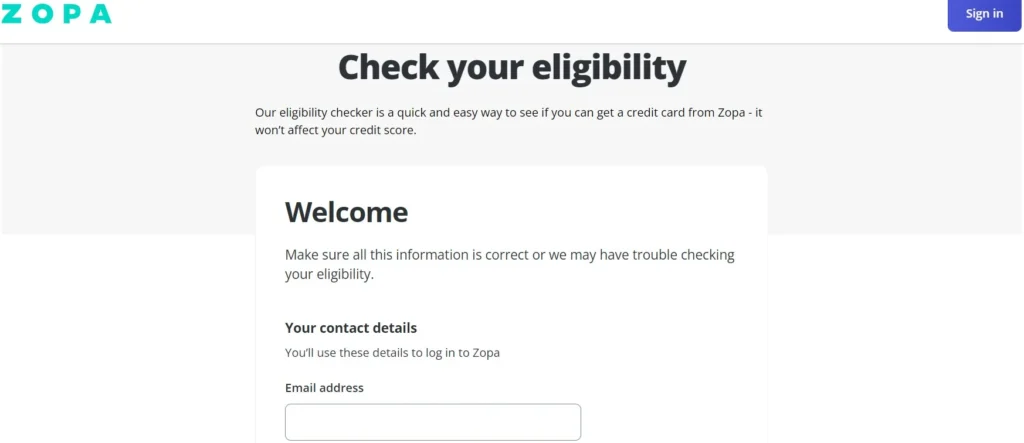

Zopa Credit Card Application Process

Here is the step by step process on How to apply Zopa Credit Card? Follow the below step to apply it easily:-

Start the Application

- Visit the Zopa website and click ‘Apply Onlne’.

- Now, you will be redirected to check your eligibility.

- You’ll need a smartphone to install the app and complete your application.

Enter Your Details for Approval

- Provide basic details like name, address, and age as shown on the screen.

- Zopa runs an eligibility check that doesn’t affect your credit score before approval.

Provide More Details

- After pre-approval, Zopa may ask for additional documentation to verify your identity, bank details, and income.

- This verification process might take a few days.

Final Credit Check

- Once you have submitted your application form, Zopa will conduct a hard credit check, which will appear on your credit report and is necessary for the final approval.

Receive & Activate Your Card:

- If your application is accepted, your credit card will be mailed within 10 working days.

- Follow the activation instructions to start using your card.

Managing Your Card through Zopa App

Managing Zopa credit cards with the Zopa app become very easy and user-friendly. Here are some of the key points that will help to use the Zopa app more efficiently:-

App as a Financial Gateway

The Zopa app is more than just a tool for checking balances. It connects you to an award-winning financial platform.

Real-Time Alerts

You can receive instant alerts for all transactions, including suspicious activities that help you control spending and protect against fraud.

Card Security

If you lose your card or notice suspicious activity, you can freeze it immediately through the app to avoid financial loss.

Payment Management

Set up direct debits via the app to avoid missing payment dates. Balance transfers to other cards are not available currently. It is under trial.

Budgeting Tools

The app integrates with budget tools and links to other financial accounts, offering a complete view of your finances. You can categorize spending, set limits, and receive alerts as you approach them.

Personalized Insights

Zopa uses your transaction data to generate personalized financial insights, helping you understand your spending habits and improve financial management.

Customer Support

Submit documents or access customer support through various methods, including chat services, directly in the app.

Customizable Dashboard

Customize the app’s dashboard to prioritize the features you use most, creating a more personal and efficient experience.

Customer reviews on Zopa Credit Card

Here are some of the positive and negative feedback of Zopa card given by its customers:-

Trustpilot Rating

Zopa has an “excellent” rating of 4.5 out of 5 from over 24,000 customers on Trustpilot.

Review Scope

These reviews cover all Zopa products, not just the credit card.

Positive Feedback

Many users praise the card for its easy application process, quick delivery, and user-friendly app.

Negative Feedback

- Some customers report issues with lost balance transfers.

- Complaints about Zopa not reversing fraudulent transactions.

- Poorly managed direct debits leading to missed payment reports, negatively impacting credit scores.

Manage Your Zopa Card Effectively

Managing your credit card is important for your financial well-being. Here are some of the points you can consider for effective use:-

Avoid Cash Withdrawals

Withdrawing cash from your credit card is expensive due to withdrawal charges and immediate interest. It can also harm your credit score, as it’s seen as poor money management by credit rating agencies.

Keep Your Credit Utilisation Low

Maintain your credit utilization below 30% of your credit limit. This demonstrates responsible financial behavior and leaves room for emergencies, positively impacting your credit score.

Set Up Automatic Payments

Automate your payments with a direct debit to ensure you never miss a payment. This prevents interest charges and keeps your account in good standing.

Use Alerts & Notifications

Enable alerts on the Zopa app to monitor transactions and balances. This helps you stay on top of your spending and identify spending habits that may need adjustment.

Inform Zopa of Any Changes in Personal Circumstances

If your financial situation changes, such as a new job or a pay rise, notify Zopa. You may qualify for better terms like higher credit limits or lower interest rates.

Always Have Cash to Pay Off Your Balance

Don’t treat your credit card as extra cash. Instead, transfer an equivalent amount from your current account to a separate savings account. This ensures you can pay off your balance in full each month, avoiding interest and accumulating savings over time.

Update Your Budget Regularly

Regularly revise your budget significantly if your financial circumstances change. The Zopa budget tool can help you stay on track with your financial goals and keep your spending within limits.

Conclusion

In conclusion, Zopa credit card, with its innovative app, provides a modern and user-friendly solution for managing personal finances.

With its straightforward features and accessible digital interface, Zopa offers a seamless experience for those seeking control over their financial activities.

Making it an excellent choice for individuals who value convenience and simplicity in their banking services.

If you have any questions, you can write it in the comment section. Also, if you like this article, share it with your friends.

Can I use Zopa Credit Card abroad?

Yes, you can use your card abroad without any fees.

Is Zopa a good credit card?

Yes, it is an excellent credit card that helps to manage transactions easily.

What is a Zopa credit card?

It is a mobile-friendly credit card that helps to improve your credit rating.

Where can I use my Zopa credit card?

You can use a Zopa card to shop and make other national or international transactions.

Hello! I’m Ella Patel, a blogger based in India with a strong specialization in the finance sector. My journey into the world of finance and writing is a blend of academic achievements and professional experiences, which I am excited to share with you