If you are searching for a credit card that provides you with many rewards, low interest rates, and different types of payment options, then a Bits Credit Card is one of the best options.

Once upon a time, I was also stuck in a decision about which credit card would be best that offer multiple rewards along with low interest rates.

After much research, visiting more than 50 websites, and watching many YouTube videos, I concluded that Bits Credit Card is the perfect choice for me.

In this blog post, I will share my experience and provide you with a detailed overview of Bits Credit Card Review, covering all the benefits, Pros and cons, and many other things you need to know before Applying for Bits Credit Card.

What is a Bits Credit Card?

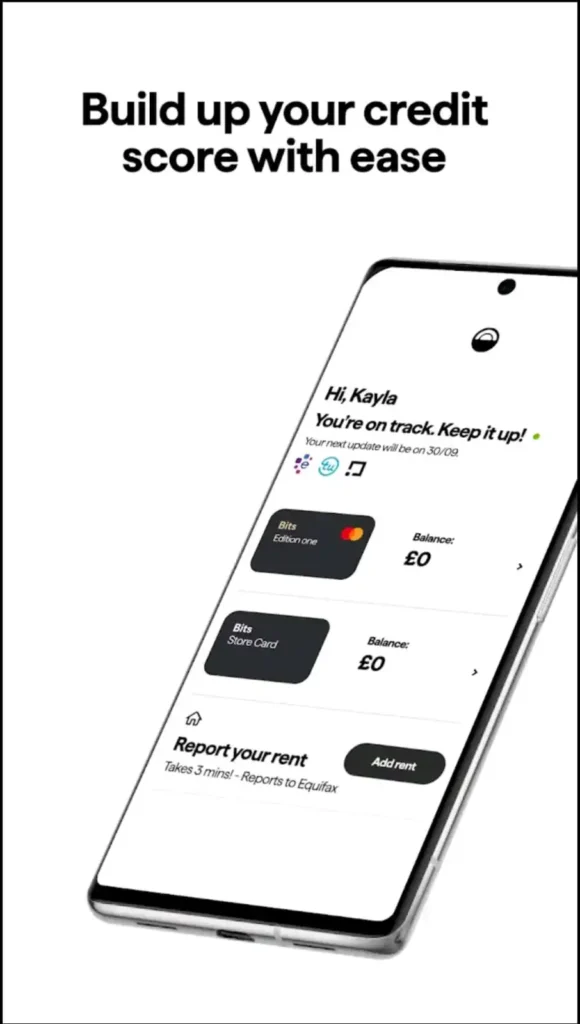

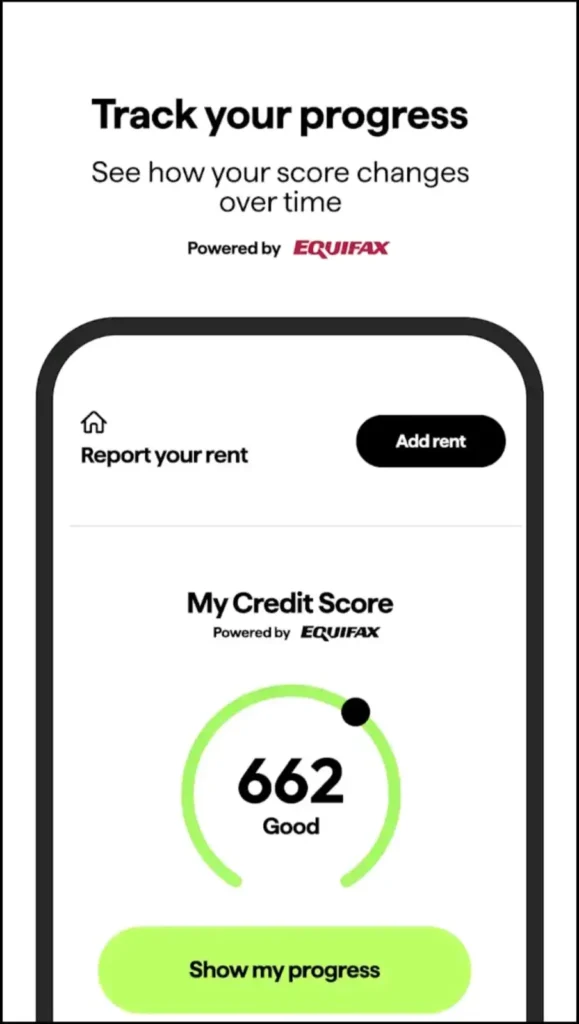

Bits Credit Card is a digital credit-building tool issued by Bits Bank that is designed to help the user improve their credit score. This means that this credit card will help you increase your credit history if you use it responsibly and pay the dues on time. Also, Bits Credit Card is designed for people who spend money every day and seek exciting rewards and offers.

| Feature | Details |

|---|---|

| Issuer | BITs Bank |

| Rewards Programme | Earn points on every purchase, redeemable for travel, merchandise, gift cards, and cash back |

| Interest Rates | Competitive low APR |

| Annual Fees | No annual fees |

| Fraud Protection | EMV chip technology, real-time fraud monitoring and zero liability for unauthorised transactions |

| Travel Benefits | Travel insurance, rental car insurance, airport lounge access, and no foreign transaction fees |

| Cash Back Offers | Cash back on groceries, dining, and fuel |

| Introductory Offers | 0% APR on purchases and balance transfers for the first 12 months |

| Customer Service | 24/7 support and a dedicated helpline for lost or stolen cards |

| Official Website | https://www.getbits.app/ |

Read about Very Credit Card Review

Eligibility Criteria of Bits Credit Card

If you want to be eligible for the Bits Card then you must meet the criteria below:-

- First of all, you should be either a student currently studying at BITS Pilani or an alum who graduated from there.

- You also need to be above a specific age threshold, that is 18 years or older.

- Lastly, you have to meet some of the bank’s income criteria regarding your earnings. This ensures you’re financially fit to manage a credit card.

So, if you are currently a student of BITS Pilani or an alumnus, over 18, and meet the bank’s income requirements, you are eligible to apply for Bits credit card.

Features of Bits Credit Card

Rewards Galore

One of the best features of the BITS credit card is its exciting rewards program. You can earn points on every purchase. These points can be used for exciting rewards like travel packages, merchandise, gift cards, and even cash back.

Low-Interest Rates

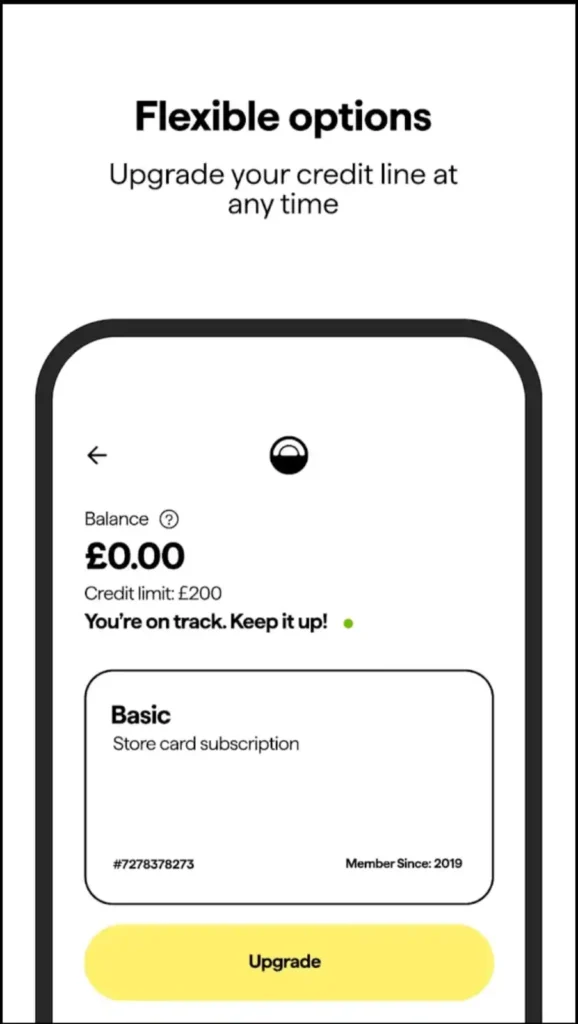

A unique feature of the BITS credit card is its remarkably low interest rates. This feature is especially beneficial for those who sometimes carry a balance. The low Annual Percentage Rate (APR) on cards helps users to spend less on interest, making it a pocket-friendly choice.

Flexible Payment Options

Flexibility in payment methods is another feature. The BITS credit card allows you to pay through various channels, including online banking, auto-debit, and mobile app payments. This multiple mode of payment helps users manage their payments conveniently and avoid late fees.

No Annual Fees

For people looking for zero annual fee, credit cards BITS credit cards are one of the perfect options. This means this feature avoids the additional costs associated with credit card ownership.

Comprehensive Fraud Protection

Security is another feature of the BITS credit card. The advanced technology of cards includes EMV chip technology, real-time fraud monitoring, and faceguards users from fraud, ensuring zero liability for unauthorized transactions.

User-Friendly Experience

The card is designed in such a way that it gives an excellent user experience, from easy online account management to responsive customer support.

Exclusive Offers and Discounts

Cardholders also gain access to exclusive deals and discounts on a variety of products and services. These special offers provide added value and make the BITS credit card even more exciting to use.

After understanding the unique features of Bits Credit Card, let’s move on to its benefits section.

Checkout Luma Credit Card Review

Benefits of BITs Credit Card

Travel Rewards

The BITs credit card comes with many travel rewards. You can enjoy travel insurance, rental car insurance, and access to airport lounges. Additionally, there are no fees for foreign transactions, making it ideal for frequent travellers.

Cash Back Offers

Beyond reward points, the BITs credit card also comes with its cash back options. You can earn cash back on groceries, dining out, and gas purchases. This turns everyday spending into a rewarding experience.

Introductory Offers

New users can benefit from welcome offers like 0% APR on purchases and balance transfers for the first 12 months. This offer is useful for those planning big purchases or transferring high-interest balances.

Customer Service

BITs Bank is known for its exceptional customer service. Cardholders have 24/7 access to customer support, ensuring quick resolution of any issues or queries. For lost or stolen cards, a dedicated number is provided to ensure fast resolution in emergencies.

How to Apply Bits Credit Card?

Here is the step-by-step guide to apply Bits Credit Card:-

- Visit the IOS App Store or Google Play store and search for Bits App.

- Now install the bits app on your mobile.

- Login to your bits app and click on the “continue” button.

- Follow the on-screen Instructions.

- Fill the necessary details and Click on the Submit Button.

Bits Credit Card vs Other Student Credit Cards

Before applying for the Bits Credit Card, always compare it with other student credit cards available on the market. For an effective comparison, always consider the following parameter, which helps you to select a better credit card for your needs:-

- Reward structure: Many credit cards offer a lot of rewards and welcome offers to attract users.

- Interest rates: The most important thing is always to compare the interest rates.

- Eligibility criteria:- Before applying for any credit card, always check your eligibility.

- Annual fees:- Consider Checking the Annual fee included with the credit card.

- Additional benefits and features: Check the extra features and security available on the credit card.

Conclusion

In conclusion, if you have a low credit score and are looking for a credit card with a low interest rate, then you can definitely look for bits credit card. You can check the features and benefits that come with this credit card.

I have mentioned all the necessary details, including how to apply for a credit card. So, by following the above instructions, you can easily apply for the card.

I hope I have solved your problem. If you have any queries left, you can write them in the comment section. Also, if you like our article, share it with your friends.

What is Bits credit card?

A Bits credit card is a digital card that helps build your credit score.

How does Bits credit card work?

Bits credit card works by reporting your on-time payments to credit bureaus.

Where can you use Bits credit card?

You can use the Bits credit card anywhere Mastercard is accepted.

How to use Bits credit card online?

Enter your Bits credit card details at checkout to use it online.

Bits credit card where to spend?

You can spend your Bits credit card at any retailer that accepts Mastercard.

Hello! I’m Ella Patel, a blogger based in India with a strong specialization in the finance sector. My journey into the world of finance and writing is a blend of academic achievements and professional experiences, which I am excited to share with you