Struggling to get approved for a credit card due to a low credit score? The Luma Credit Card might just be your solution.

Key Takeaways

- Credit Building Made Easy: Luma Credit Card helps users with poor credit history improve their scores.

- No Annual Fee: Enjoy cost-effective credit management without annual or joining fees.

- Simple Application Process: Check your eligibility online in minutes.

- Enhanced Security: Features like anti-theft protection and fraud alerts ensure your financial safety.

- Flexible Usage: Ideal for everyday purchases while rebuilding credit

Credit cards are crucial to our daily lives. Having a card like a Luma credit card makes life much easier. But what if your credit score is very poor? Have you applied for many credit cards but haven’t received approval? So, you have landed on the right page.

In this article, I will discuss a detailed review of the Luma Credit card. One that allows users to apply even if they have a very poor credit score means you can get approval with a very low credit score.

Moreover, I will also deep dive into the step-by-step process of how you can apply for a Luma Card, the activation process, how to cancel a Luma credit card, and many more.

Before moving further in the article, let’s understand the Luma Credit card.

What is Luma Credit Card?

Luma Card is a credit card builder that facilitates users’ building or rebuilding their credit history. If you have a very low credit history, you can also get approved. This feature makes the Luma Credit Card more popular among users.

Who owns Luma credit card?

Capital One is a well-known financial institution in the United Kingdom that owns Luma Credit Card. It is responsible for issuing, managing, and servicing the Luma Credit Card accounts. Capital One also provides the infrastructure and support for cardholders, including customer service, billing, and reporting to credit bureaus.

Before moving on to how to apply for a Luma credit card, it is important to know its features and all the pros and cons.

What are the Key Features of Luma Credit Card?

Now, let’s understand the features of the Luma Card that will help you make your decision.

- This Credit Card is customized in such a way that it helps the user build their credit score.

- Luma Credit Card doesn’t come with any welcome offers.

- It charges a Variable ARP of 35.9%.

- Luma Card doesn’t charge you any annual or joining fees.

- Also, it doesn’t offer any special perks.

Suggestion

If you are looking for a credit card with a low credit score, then you can move forward with Luma Credit Card.

Pros and Cons of Luma Credit Card

| Pros | Cons |

|---|---|

| It helps users to improve credit score. | It changes $12 as a late fine if you fail to pay bill on time. |

| It helps users to improve their credit scores. | The credit limit of the Luma card is $1500 and can be increased over time. |

| The initial credit limit is very low at the start, with $200. | This card also comes with anti-theft protection, providing extra security. |

Read More about:- How to Apply Onmo Credit Card?

How to Apply for Luma Credit Card?

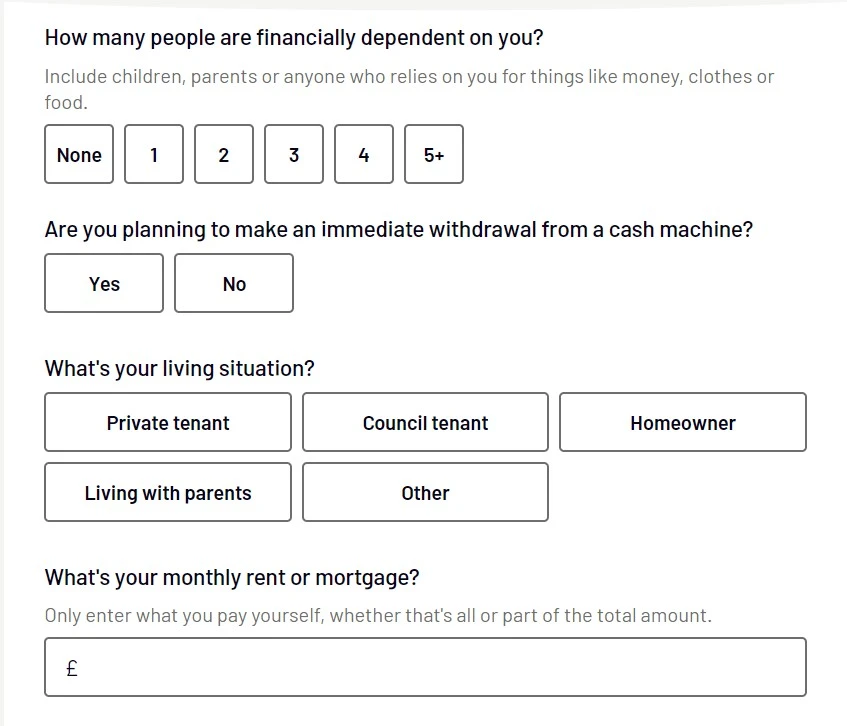

To apply for the Luma card, you need to follow the below step:-

First of all, visit the official website of Luma credit card.

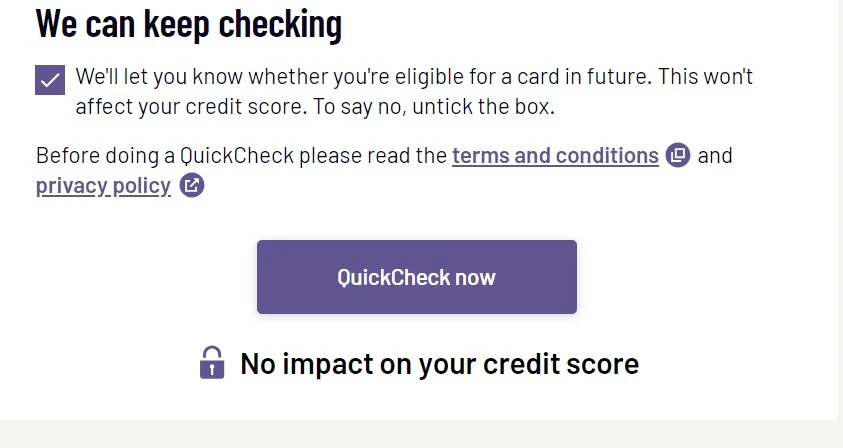

Now, to check your eligibility, click on the Quickcheck Now button for the further process.

After clicking on the button, you will be redirected to fill out the application form.

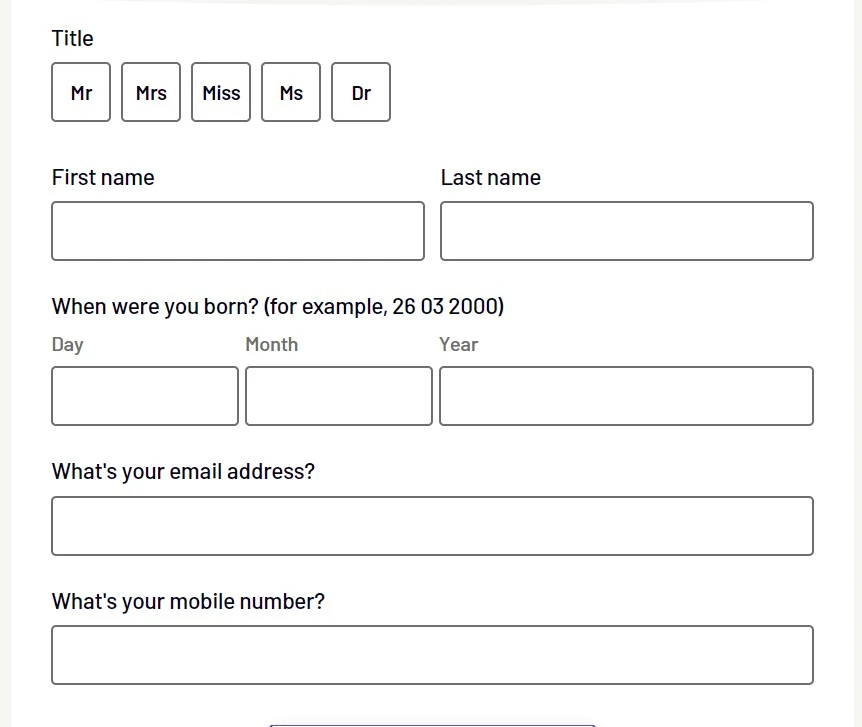

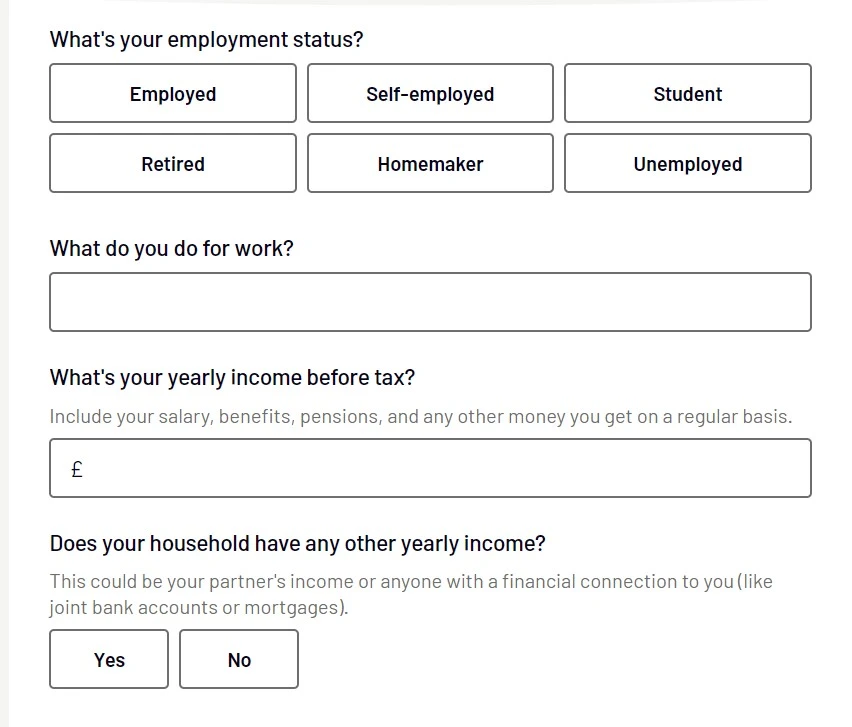

Fill in the necessary details asked in the portal. (as shown below)

Check your detail twice and click on Quickcheck Now for final submission.

After submitting the form, it will take roughly 60 sec to get your response on your eligibility.

After completing all the forms, the application will take a look at your credit history.

This process will not affect your credit rating, so you can complete it without any fear.

For any kind of query, you can contact the support team at the helpline number mentioned in the article below.

Checkout Bits Credit Card

Benefits of Luma Credit Card?

Accessible Eligibility: Applying for a Luma credit card is easier than applying for some other credit cards because there are fewer complications. It is suitable for individuals with limited credit history or low credit scores.

No Annual Fee: Luma does not charge an annual fee, making it a cost-effective option compared to many other credit cards.

Transparent Fees: Luma emphasizes clarity regarding its fees. There is no confusion about any charges, such as late payment fees or other potential costs.

Online Account Management & Mobile App: Luma offers easy online and mobile account management. Users can track transactions, check their balances, and make payments conveniently from their computer or phone.

Additional Cardholders: You can add authorized users to your credit card, helping to manage household expenses or build someone else’s credit history. However, note that the primary cardholder is responsible for all charges made by authorized users.

Security Features: Luma provides robust security measures, including free identity theft protection and automatic fraud alerts, ensuring users’ financial information is well-protected.

How to activate Luma credit card?

To activate Luma card, there are two ways you can choose either of them.

- Activate your card using the mobile app and follow the steps.

- You can call customer support to activate it directly.

Both the process is very simple. You can follow anyone and get your card active without any hassle.

Who Should Consider the Luma Credit Card?

The Luma credit card can be a good option for people looking for:-

- People wants to improve Credit Score: If you are looking for a credit card that helps to improve your credit score, then Luma Credit Card is one of the best options for you.

- People with Credit History: Luma cards help users build and rebuild their credit history if they pay their bills on time.

- People Like Clear and Simple Fees: The Luma Card has no annual or joining Charges and offers an excellent user experience, making it more user friendly.

Luma Card Customer Support

If you face any difficulties or have any questions regarding the Luma card, you can chat through the message section or call it directly to customer support.

- Monday to Friday 7 am – 9 pm

- Saturday & Sunday 8 am – 5 pm

| General account | 0333 000 0477 |

| General account (if you are calling from outside of the UK) | +44 333 0000 433 |

| Online account | 03444 814 000 |

| Report your card lost or stolen | 0800 597 0178 |

| Report your card lost or stolen from abroad | +44 333 0000 433 |

Conclusion

In the above article, I have discussed the Luma credit card, how to apply, and the necessary details you must know before applying for the Card. So, if you are looking for a credit card with a low credit history, you can definitely consider this card as well.

This card also has a large user base with very high positive user feedback. Finally, make your decision wisely and consider all the pros and cons before choosing your credit card.

I hope I have solved your problem. If you have any questions regarding this article, do let me know in the comment section. Also, if you like this article, do share it with your friends and family.

Who owns luma credit card?

Capital One is the company that owns luna credit card.

How do I activate my luma credit card

You can activate it by calling customer support directly on 03444 814 000

Where can i use my luma credit card

You can use the credit card for multiple purposes like shopping, etc.

Hello, I’m Emily Hart, a finance writer focused on UK personal finance and consumer credit. I research and review UK credit cards, loans, and financial products to help readers understand their options and make informed decisions. My work is grounded in careful analysis of product features, terms, and publicly available information, with the goal of presenting complex financial topics in a clear and practical way